Struggling with late payments and disorganized invoices? Managing billing manually can drain time and create errors. Client invoicing software simplifies payments, automates reminders, and keeps records accurate.

With the right tools, businesses streamline invoicing, reduce disputes, and improve cash flow. Automated features ensure timely payments while minimizing manual work. This boosts efficiency and enhances client relationships.

This article explores the top client invoicing software and the features they offer. Let’s dive right into it.

Quick List of Best Client Invoicing Software:

- Agency Handy: A great choice for handling recurring invoices and subscriptions with automation and customization.

- QuickBooks: Ideal for businesses needing full accounting integration with invoicing and expense tracking.

- FreshBooks: Perfect for small businesses that need easy client billing, time tracking, and hassle-free invoice creation.

- Zoho Invoice: Good for small businesses seeking affordable, scalable invoicing with multi-currency support.

- Square Invoices: Ideal for those who need fast, mobile-friendly invoicing with low transaction fees.

- Invoice2go: Designed for entrepreneurs who need quick, professional invoices with instant tracking and reminders.

- Wave Invoicing: A budget-friendly solution offering free invoicing and bookkeeping with powerful features.

What are the Key Benefits of Using Client Invoicing Software?

Client invoicing software offers several key benefits for agencies —

- Quick Invoicing Process: You don’t have to create and send invoices manually. The software automates everything—invoice creation, tracking, and delivery. This saves you time and reduces mistakes, so you can focus on your work instead of paperwork.

- Better Cash Flow: With quicker invoice delivery and online payment options, clients can pay you faster. This keeps your cash flow steady and helps you avoid financial slowdowns.

- More Professional Look: Clean, well-designed invoices make you look more professional. Branded invoices with your logo and details give clients confidence in your business.

- Fewer Errors and Disputes: Automatic calculations prevent mistakes that could lead to payment disputes. When invoices are accurate, clients pay on time, and you avoid accounting headaches.

- Easy Tracking and Reports: You can see unpaid invoices, received payments, and total revenue all in one place. This helps you track your finances and make better business decisions.

- Clearer Communication with Clients: Some invoicing tools send automatic reminders and give clients access to their billing history. This keeps everything transparent, reduces confusion, and ensures smoother payments.

Comparison Table of Best Client Invoicing Software

Here’s a concise table to show you the features of the client billing software —

| Features | Automated Invoicing | AutomatedPaymentReminders | Split Payment Options | Payment Types | Pricing (Billed Annually) |

| Agency Handy | ✔️ | ✔️ | ✔️ | – PayPal- Wise- Stripe- Manual Banking | $19/month |

| QuickBooks Online | ✔️ | ✔️ | Yes (more complex setup) | – Online payments- ACH transfers- Checks | $97/year |

| FreshBooks | ✔️ | ✔️ | ✔️ | – Online payments- Credit cards- ACH transfers | $160/year |

| Zoho Invoice | ✔️ | ✔️ | Yes (with some limitations) | – Online payments- credit cards- ACH transfers | Free |

| Square Invoices | ✔️ | ❌ | ✔️ | – Credit/debit cards- ACH transfers- Square Pay | Free |

| Invoice2go | ✔️ | ❌ | ❌ | – Credit/debit cards- PayPal | $400/year |

| Wave Invoicing | ✔️ | ❌ | ❌ | – Online payments- credit cards- Bank payments | $170/year |

7 Best Client Invoicing Software for Smoother Client Billing

During our reserch, we focused on features like flexible invoicing, automation, splitting payments, managing quotes, etc. Let’s explore them to find the perfect invoicing solution.

1. Agency Handy

Agency Handy is your one-stop invoicing solution, whether it’s a regular or recurring invoice. It connects invoicing with other agency management features to keep your workflow organized.

Starting off, you can experience white labeling invoicing that matches your brand. Add your logo, customize layouts, and present a professional image that builds trust with clients.

And if you work with repeat clients, you don’t have to send invoices manually every time. Automated billing takes care of recurring payments, saving you time and ensuring you get paid on schedule.

Clients can pay in a way that suits them. Whether they prefer split payments, upfront deposits, or milestone-based transactions, the system supports it all. It totally depends on your contract.

Moreover, the platform supports PayPal, Stripe, Wise, and manual banking. Clients can choose the most convenient option, so you never have to chase payments.

One interesting feature is automated payment reminder schedules. With customizable reminders, clients receive automatic alerts, keeping payments on track and ensuring your business runs smoothly.

Beyond invoicing, the built-in ticketing system helps you manage client support. All requests stay in one place, making it easier to track issues and respond quickly.

Key Feature of Agency Handy

Agency Handy simplifies every aspect of your workflow with a diverse range of features that take care of your entire customer journey, including invoicing:

1. Invoicing and Payments

Forget manual billing. Create automated or custom invoices in any currency with white-label options. Accept payments through Stripe, PayPal, Wise, or direct bank transfers. Clients get multiple ways to pay, making transactions smooth and hassle-free.

2. Customizable Invoice Templates

It allows you to design invoices that reflect your brand identity and business needs. Remember, consistent and branded invoices improve client trust and recognition.

3. Track Time for Accurate Billing

If you bill by the hour, real-time tracking ensures you log every minute accurately. Track hours manually or automatically, attach notes to tasks and generate invoices based on logged time. This feature eliminates guesswork and ensures you get paid fairly for the work you do.

5. Quote and Proposal Management

Save time with ready-to-use proposals and contract templates. Clearly outline deliverables, pricing, and timelines, making expectations clear from the start. With built-in e-signature functionality, clients can approve and finalize contracts instantly—no more waiting on back-and-forth emails.

6. CRM with Lead Tracking

Never lose track of potential clients again. With a centralized CRM, you can organize leads, assign follow-ups, and monitor every stage of the sales process. Team members can be assigned to specific prospects, ensuring a smooth transition from lead to client.

7. Manage Your Services

Showcase what you offer with a customized service catalog. Create detailed listings, complete with up to three pricing tiers, descriptions, and FAQs. To build trust, you can even add a portfolio that highlights past work and successful projects. Set up personalized discount codes or limited-time trials, allowing potential clients to test your services before committing.

8. Custom Forms for Onboarding

Get all the details you need upfront with custom intake and order forms. Whether collecting basic client info or gathering project-specific details, these forms keep everything structured. You can integrate forms before or after payment, ensuring all necessary data is in place before work begins.

9. Order and Task Management

Easily create, assign, and track tasks to keep projects moving forward. Whether manually setting up tasks or automating them based on service selections, you’ll always know what’s next.

Clients can monitor progress, provide feedback, and approve deliverables directly from their dashboard, reducing unnecessary back-and-forth communication. The Kanban-style board helps you visualize workflows and stay on schedule.

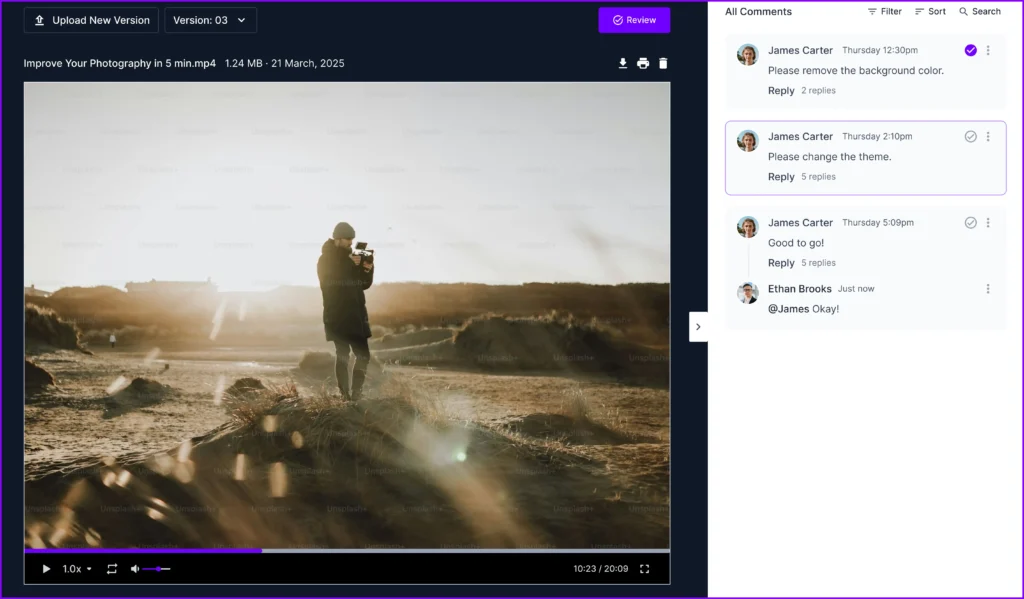

10. Get Client Feedback

Skip the hassle of multiple tools—collect feedback right where it matters. Clients can leave comments directly on images, videos, PDFs, or even live websites using built-in annotation tools.

Every revision is logged, ensuring transparency and easy access to previous versions. This feature keeps your team aligned and speeds up approvals.

Best Use Case of Agency Handy

Here are some key ways agencies can use Agency Handy for better invoicing —

- Creative Agencies: You can automate billing based on project milestones or hourly work. Custom invoice templates keep your branding consistent. If you work on large projects, split payment options let clients pay in stages, making transactions smoother.

- Marketing Agencies: Marketing agencies can generate accurate invoices for retainer fees or performance metrics. Automated invoicing and payment tracking streamline billing and cash flow management.

- Web Development Agencies: Send invoices for different project phases, such as design, development, and testing. Automated billing ensures you send invoices on time, while client management tools help you track payment history.

- Consulting Agencies: Consulting agencies can generate invoices for hourly rates or project-based pricing. Recurring billing management and payment tracking prevent overlooked invoices.

- PR Agencies: Manage billable hours or flat-rate services without extra work. Automated invoicing keeps everything on schedule, while customizable templates give your invoices a professional touch.

Pros of Agency Handy

- Kanban view for lead tracking makes nurturing easy.

- Trial period for service packages helps target reluctant prospects.

- Client data is secured with permission and access control.

- You can automate task creation for specific services.

- Multi-currency and multi-language support for global business.

Agency Handy Pricing

Choose the right Agency Handy plan from the three plans and unlock the features your agency requires:

What Users Say About Agency Handy?

Rating on Capterra: 5 out of 5

“Agency Handy is an all-in-one solution that has streamlined our operations, improved client satisfaction, and boosted team productivity.” – Priyanka P.

Rating on G2: 5 out of 5

“It helps me sell my services with ease. Also, you can collaborate with your team in serving your customers within the platform.” – Franklin N.

Rating on Product Hunt: 5 out of 5

“If you are handling multiple clients or an agency, try it out. One of the best solutions to manage everything in one place.” – KH Sayed

Rating on Trustpilot: 3.8 out of 5

“I am extremely satisfied with Agency Handy. It has streamlined our client management process and has become an essential tool for our business operations.” – Vikas Patil.

Why Should You Choose Agency Handy as Client Invoicing Software?

Here are a few major reasons to go for the Agency handy —

| Common Client Invoicing Challenges | How Agency Handy Helps Agencies |

| Manual invoicing is slow and error-prone. | Automated invoicing generates accurate, scheduled invoices with minimal effort. |

| Difficulty tracking payment overdue | The payment tracking dashboard logs transactions and shows invoice status |

| Looks less professional and polished | Custom-branded templates ensure polished, consistent, and professional invoices. |

| Delays in getting paid due to inefficiency. | Scheduled invoicing and payment reminders improve on-time payments. |

| No flexible payment options for clients. | Supports split payments, deposits, and multiple payment gateways like Stripe, PayPal, Wise, etc. |

2. QuickBooks

QuickBooks is good choice for small businesses and freelancers for its intuitive and feature-rich platform.

Whether you’re on a desktop or mobile device, you can create and send invoices in minutes, track payments, and manage billing your clients with ease. It even lets you send invoices via WhatsApp.

For businesses with recurring billing, automated invoicing removes manual work. Set up scheduled invoices, reduce errors, and keep cash flow steady without extra effort.

Need to bill international clients? Multi-currency support allows you to send invoices and track payments in different currencies, making global transactions simple.

These tools help businesses maintain timely, professional, and accurate invoicing, leading to better client relationships and repeat business.

In contrast to Agency Handy, which lets you track time for both payroll and client billing, QuickBooks lacks advanced time-tracking features.

Key Features of QuickBooks

Following are some of the major features of QuickBooks —

- Customizable Invoices: It allows you to create professional-looking invoices with your company logo and branding. Thus, you can customize invoice layouts and include specific details relevant to each client.

- Automated Invoicing: QuickBooks helps you to set up recurring invoices for regular clients or subscriptions. It automates the billing process and saves time.

- Online Payment Acceptance: This platform accepts online payments directly through invoices via various payment gateways. So, it simplifies the payment process for your clients and improves cash flow.

- Payment Tracking and Reminders: It can track invoice status (sent, viewed, paid, overdue) and send automated payment reminders. This helps manage outstanding balances and ensures timely payments.

- Reporting and Analytics: QuickBooks allows you to generate reports on sales, outstanding invoices, and other financial data. That way, you can gain insights into your business’s financial performance.

Pros of Using QuickBooks

- Offers customizable invoice templates for a professional brand image.

- Automates recurring invoices, saving time for subscription-based businesses.

- Tracks income, expenses, and outstanding payments for financial clarity.

- Organizes financial data for easier tax preparation.

- Generates reports with insights into business performance.

Cons of Using QuickBooks

- Certain plans impose limits on the number of transactions.

QuickBooks Pricing

QuickBooks offers multiple pricing plans, ranging from basic invoicing tools to advanced accounting features for growing businesses.

What Do Users Say About QuickBooks?

Rate on Capterra: 4.3 out of 5

“Great Product; Easy to Use and Configure

Overall: Used Desktop online for more than 10 years. Moved to QBO in 2023. Like the ability to access data across multiple devices.

Pros: Easy to configure, manage and use this system.

Cons: Would like to have more features tailored to construction project management. Also, not thrilled with pricing.” – Stephen J.

3. FreshBooks

FreshBooks is a user-friendly accounting solution designed to streamline invoicing, expense tracking, and time management.

Its simple interface makes sending professional invoices effortless, allowing businesses to manage payments with ease. Setting it up is quick—just create an account and link your bank.

This platform is especially useful for service-based businesses that charge by the hour. With built-in time tracking, it helps freelancers and small teams log billable hours and generate accurate invoices.

However, FreshBooks lacks the advanced project management features needed for handling large-scale operations or complex workflows. While it covers invoicing and time tracking well, other platforms offer more robust tools.

For example, QuickBooks includes inventory tracking, making it a better fit for businesses that sell both products and services. If you need a comprehensive accounting and inventory management system, QuickBooks may be the stronger choice.

Features of FreshBooks

Check out FreshBooks’ noteworthy features —

- Customizable Invoices: It offers to create branded invoices with logos and personalized messaging. Thus, you can customize invoice layouts to match your business’s style.

- Automated Payment Reminders: You can automatically send reminders for overdue invoices. It helps improve cash flow and reduces manual follow-up.

- Online Payment Acceptance: FreshBooks accepts online payments via various gateways, offering clients convenient payment options. So, it speeds up your payment process.

- Expense Tracking: It allows you to track your business expenses and link them to invoices. This simplifies expense reporting and improves financial oversight.

- Time Tracking: You can easily track billable hours and automatically add them to invoices. This ensures accurate billing for time-based services.

Pros of Using FreshBooks

- User-friendly interface makes invoicing quick and easy.

- Excellent time tracking features for service-based businesses.

- Strong focus on client communication and collaboration.

- Mobile app allows for invoicing on the go.

Cons of Using FreshBooks

- Working with larger projects can be complicated.

Pricing FreshBooks

FreshBooks offers flexible pricing plans, with tiered options catering to freelancers, small businesses, and growing teams needing advanced features.

What Do Users Say About FreshBooks?

Rate on Capterra: 4.5 out of 5

“Excellent Value Easy To Use Platform

Overall: Excellent overall experience, great value and easy to use platform.

Pros: Easy to use, low cost, has everything needed for small to mid-size businesses.

Cons: Nothing comes to mind about dislikes, perhaps integration into CRMs.” – Neil J.

4. Zoho Invoice

Looking for an invoicing tool that’s powerful yet free? Zoho Invoice offers an intuitive, feature-rich platform designed to make billing effortless while keeping clients happy.

With customizable invoice templates, you can send polished, professional invoices in just a few clicks. Its automated billing ensures clients receive invoices on time, eliminating manual work and reducing late payments.

Tracking payments is seamless with real-time notifications and reminders. Clients can pay online through multiple gateways, making transactions quick and hassle-free.

For global businesses, multi-currency and multi-language support allow you to invoice international clients with ease, ensuring clear communication and smooth payments.

Compared to FreshBooks, Zoho Invoice stands out with its completely free plan, offering up to 1,000 invoices annually—ideal for freelancers and small businesses. FreshBooks’ entry plan limits users to only five billable clients, making Zoho a better choice for growing businesses that need flexibility.

Features of Zoho Invoice

Here are the top features of Zoho Invoice that make it a very strong client invoicing software:

- Customizable Invoice Templates: You can create invoices that truly represent your brand. Customize templates to fit your business style and meet client preferences effortlessly.

- Automated Payment Reminders: It automatically notifies your clients about due payments to reduce delays and improve your cash flow without extra effort.

- Online Payment Options: Zoho Invoice accepts payments online using multiple gateways, offering convenience and ensuring quicker transactions.

- Expense Tracking: You can track expenses and link them to specific invoices. Thus, expense management becomes simpler and gives you a clearer view of profitability.

- Client Portal: It gives your clients a dedicated space to view invoices and make payments. This makes communication easier and empowers them with a self-service option.

Pros of Using Zoho Invoice

- Provides smooth integration with other Zoho and third-party apps.

- Simplifies setup with an intuitive, user-friendly interface.

- Enables real-time notifications and payment tracking.

- Supports multiple currencies for international business needs.

- Offers excellent affordability with an all-in-one solution.

Cons of Using Zoho Invoice

- Support teams for different tools lack consistency.

Zoho Invoice Pricing

Zoho Invoice is one of the best invoicing software for small business owners, freelancers, and entrepreneurs. And the best part is you can use it for free.

What Do Users Say About Zoho CRM?

Rate on Capterra: 4.7 out of 5

“Free and truly helpful accounting platform

Overall: Great! Simple process for creating invoices, tracking expenses and keeping on top of my company’s accounting.

Pros: Absolutely FREE to use! It is a very user-friendly platform with easy to get started user experience. It succeeds in meeting all the needs of managing the very basics of accounting like creating and sending a quote, an invoice, and more.

Cons: It does not have a lot of functionalities like Zoho Books nevertheless, it acts as a great free accounting platform with many of the fundamental functions covered.” – Sarp O.

5. Square Invoices

Square Invoices takes the hassle out of billing with automated reminders, professional designs, and flexible payment methods—ensuring smooth transactions and happy clients.

Your brand matters, even in your invoices. With Square, you can customize invoice templates to match your business identity, keeping things polished and professional.

Late payments can be frustrating, but automatic reminders help clients pay on time. They can settle bills using credit cards or ACH transfers, making payments quick and hassle-free.

If you offer ongoing services, Square’s recurring billing feature saves you time. Set a schedule once, and Square will send invoices automatically. No more manual invoicing—just smooth, hands-free billing, so you can focus on your work instead of chasing payments.

Tracking invoices is just as easy. You’ll know when a client opens and pays an invoice, helping you stay informed and maintain clear communication. No guessing, no back-and-forth—just real-time updates for better transparency.

When comparing Square to Zoho Invoice, the difference is clear. Square charges a fixed processing fee per transaction, while Zoho gives you the flexibility to choose from multiple payment gateways. If you want a system with built-in payment processing, Square is a solid choice.

Features of Square Invoices

Aside from a few limitations, Square Invoices offer some pretty useful features —

- Unlimited Invoices: You can send an unlimited number of invoices for free using Square Invoice. It’s beneficial for businesses with high invoice volume.

- Online Payments: It can accept various online payment methods, including credit/debit cards and ACH transfers. This provides your clients with convenient payment options.

- Automatic Payment Reminders: Using its automated reminders, you can notify your clients for overdue invoices. It helps to improve your cash flow and reduces the need for manual follow-up.

- Invoice Tracking: Square Invoices also tracks the status of sent invoices, including when they’re viewed and paid. Thus, you get a a clear overview of outstanding balances.

- Mobile Invoicing: You can easily create and send invoices from your mobile device, providing flexibility for businesses on the go.

Pros of Using Square Invoices:

- Sends unlimited invoices in completely free plan.

- Integrates seamlessly with Square’s point-of-sale system for businesses that accept both online and in-person payments.

- Facilitates quick and easy online payment acceptance.

- Provides decent customization for invoice templates for branding.

- Improve communication and self-service with a client portal.

Cons of Using Square Invoices:

- Reporting capabilities are fairly basic.

- Transaction fees for each online payment processed.

Square Invoices Pricing:

Square Invoices offers a free plan with basic invoicing features and a Plus plan with advanced automation and customization.

What Do Users Say About Square Invoices?

Rate on Capterra: 4.7 out of 5

“The BEST

Overall: Amazing! Have always received good quality products, great customer service, and amazing online products and services!

Pros: It’s super quick and easy to get paid using this software. And you can use it anywhere!

Cons: I have no real cons. It does what I expect and need it to.

Reasons for Choosing Square Invoices: Because I already knew of their card processing services and had that so I figured why not keep it in the family and I’m so glad I did!” – Kiersten D.

6. Invoice2go

Invoice2go simplifies invoicing for small businesses and freelancers. It gives you the tools to create invoices, track payments, and manage expenses—all in one place.

With just a few clicks, you can generate and customize invoices to reflect your brand. You don’t have to worry about late payments either. The platform lets you track payments in real-time and sends automatic reminders to clients who miss due dates. Logging expenses is just as easy, helping you keep your finances in order.

Getting paid is seamless. Invoice2go integrates with multiple payment gateways, so clients can pay online securely and without hassle. The interface is straightforward and easy to use, requiring no time to learn. Whether you’re on a computer or using the mobile app, you can manage your invoices from anywhere.

Automation helps you work faster. Instead of spending hours on paperwork, you can generate professional invoices, track payments, and organize your finances with built-in reports. Everything runs smoothly, so you can focus on growing your business.

However, if you manage multiple locations, Invoice2go might not be the best fit. It lacks multi-location support, a feature Square Invoices offers for businesses that need seamless invoicing across different locations.

Features of Invoice2go:

Here are the top Invoice2go features that make it a great choice for your business:

- Mobile Invoice Creation: Create and send professional invoices directly from your smartphone or tablet. This allows for invoicing on the go, immediately after completing a job.

- Pre-designed Invoice Templates: Choose from a variety of professionally designed invoice templates. This simplifies invoice creation and ensures a polished look.

- Payment Tracking: Track the status of sent invoices and receive notifications when payments are received. This helps manage outstanding invoices and improves cash flow.

- Expense Tracking: Record business expenses and link them to invoices. This provides a basic overview of income and expenses.

- Basic Reporting: Generate simple reports on sales and outstanding balances. This offers a basic understanding of financial performance.

Pros of Using Invoice2go:

- Provides a user-friendly mobile app for creating and sending invoices.

- Offers a straightforward interface that is easy to learn and use.

- Ready-made templates, saving time and effort.

- Facilitates online payments through various gateways.

- Create and send estimates and quotes, converted into invoices upon approval.

Cons of Using Invoice2go:

- Pricing based on invoices sent; costly for high-volume businesses.

Invoice2go Pricing:

Invoice2go offers three annual pricing tiers: Starter, Professional, and Premium.

What Do Users Say About Invoice2go?

Rate on Capterra: 4.3 out of 5

“Professional Invoicing App!

Pros: The application is very user friendly, it takes time to setup all your services and items but once you do, you’d be sending invoices in seconds.

Cons: Very limited integrations and pricing point can be better compared to alternatives” – Melissa S.

7. Wave Invoicing

Wave Invoicing can help your business to create, customize, and send invoices with ease—all while maintaining a polished, professional look.

Late payments can slow down your business, but Wave helps you stay ahead. With recurring billing and automated payment reminders, clients are more likely to pay on time. They can also settle invoices online, making the process faster and keeping your cash flow steady.

Everything connects seamlessly. Wave integrates with its own accounting tools, so you can track income and manage finances in one place. No need for multiple platforms—just a smooth, organized system that saves you time.

Getting started is quick. Sign up, add your business details, and start sending invoices right away. Whether you’re working on a computer or using the mobile app, you can manage your billing from anywhere.

One thing to keep in mind—Wave doesn’t include built-in expense tracking. If you need detailed financial tracking along with invoicing, Refrens might be a better option.

Features of Wave Invoicing:

Wave Invoicing offers a powerful set of tools designed to streamline billing, enhance client relationships, and improve customer retention. Here are its top features:

- Professional Invoice Customization: Create sleek, personalized invoices with your branding, logo, and colors to leave a professional impression on clients.

- Recurring Billing: Automate invoices for repeat customers, ensuring they receive timely bills without manual effort, improving cash flow and consistency.

- Automated Payment Reminders: Reduce overdue payments with scheduled reminders that gently prompt clients to settle their invoices on time.

- Online Payment Integration: Accept credit cards, bank transfers, and Apple Pay directly through invoices, making payments quick and hassle-free for clients.

- Client Management: Store and organize client details, payment histories, and past invoices to personalize interactions and improve long-term relationships.

- Mobile Accessibility: Manage invoices, send payment reminders, and track payments from anywhere using Wave’s mobile app for added convenience.

- Expense Tracking: Keep an eye on business expenses, categorize costs, and match them with revenue to maintain financial transparency.

- Financial Reporting: Generate detailed reports on client payments, outstanding invoices, and business performance to make informed financial decisions.

Pros of Using Wave Invoicing:

- Free plan with unlimited invoicing.

- Integrates with Wave Accounting and Payments.

- User-friendly and easy to navigate.

- Automated reminders for timely payments.

- Supports multiple online payment gateways.

Cons of Using Wave Invoicing:

- Slower customer support response times for free users.

- Limited customization compared to paid tools.

Wave Invoicing Pricing:

Wave Invoicing offers a free plan with unlimited invoicing, with optional paid add-ons for payments, payroll, and accounting features.

What Do Users Say About Wave Invoicing?

Rate on Capterra: 4.4 out of 5

“Wave is Amazing!!

Overall: Great experience overall and I have been using this software since 2020.

Pros: Wave is easy to use and a huge time saver when it comes to tracking expenses and doing reports. Best thing about it is that it is free for the starter edition.

Cons: You can’t send an estimate directly through Wave without the paid plan but it is a small issue.” – Andrea A.

Key Features to Consider in a Client Invoicing Software

Choosing the right invoicing software can save you time and make payments smoother. The right tool helps you manage invoices, track payments, and keep your finances organized. Here are the key features to consider:

- Automated Invoicing – Save time by generating and sending invoices automatically. Recurring invoicing is perfect for long-term clients, reducing manual work.

- Customizable Invoice Templates – Make your invoices look professional and on-brand. Add your logo, colors, and custom fields to match your business identity.

- Split Payment Options – Give clients the flexibility to pay in installments or use multiple payment methods. This makes transactions easier and improves customer satisfaction.

- Quote and Proposal Management – Quickly create quotes and proposals. Once approved, convert them into invoices with a single click, speeding up the onboarding process.

- Client Management Tools – Keep all client details in one place. Track billing history, payment preferences, and communication logs for better organization and smoother interactions.

- Payment Tracking and Reminders – Monitor payments in real time and send automatic reminders for overdue invoices. This helps maintain steady cash flow.

- Multi-Currency and Multi-Language Support – Invoice clients worldwide with ease. Accept different currencies and provide invoices in multiple languages for a seamless experience.

So, Which One is the Best Client Invoicing Software?

Agency Handy is the best client invoicing software for agencies. It’s white-label invoicing with support from popular payment gateways, gives you the flexibility and professionalism you need.

You can also consider QuickBooks and FreshBooks. QuickBooks is more suitable for businesses needing comprehensive financial management. FreshBooks provides user-friendly invoicing and time tracking, ideal for service-based businesses.

Conclusion:

Choosing the right invoicing software is a big deal for any business. It’s important to look at your budget and pick something that won’t break the bank. Regularly check your data for accuracy to avoid issues.

Encourage collaboration among your team to make sure everyone is on the same page. Choose software that supports easy sharing and access for all team members.

Remember, the right software can boost your business’s efficiency and keep your clients happy. Choose wisely and enjoy the benefits!

Frequently Asked Questions (FAQs)

How does Agency Handy compare to other invoicing software?

Agency Handy stands out with its centralized dashboard that integrates project management with invoicing clients. It offers robust client and financial management, making it ideal for agencies.

Is FreshBooks suitable for larger businesses?

FreshBooks is great for small businesses and freelancers due to its intuitive design and ease of use. However, larger businesses might need more advanced features available in other tools.

Can I collaborate with my team using invoicing software?

Yes, tools like Agency Handy and Monday.com allow team sharing and real-time collaboration. These features ensure smooth invoicing workflows across your team.

Can I use free invoicing software for my business?

Yes, many invoicing tools like Wave and Zoho Invoice offer free plans. However, these may lack advanced features such as multi-client management or extensive integrations, which are crucial for larger businesses or agencies.

Can I switch to a different invoicing software later?

Yes, but ensure the new software supports data migration. To avoid disruptions, exporting and importing client and invoicing data should be straightforward.