Late payments are a common business struggle, impacting finances and peace of mind. Nearly 73% of companies chase multiple overdue invoices, with many owing significant amounts.

Beyond the financial hit, late payments create stress and anxiety, leaving many worried about covering bills, taxes, and staff salaries. But chasing payments doesn’t have to be uncomfortable or aggressive.

You can follow the steps below to chase invoice payments effectively:

- Send a polite reminder before the due date

- Follow up regularly for overdue payments

- Suspend work until payment is made

- Reissue the invoice marked as ‘Overdue’

- Offer flexible payment options

- Send a final warning before taking action

In this guide, we’ll walk you through practical steps to handle overdue invoices and maintain a good client relationship.

How to Chase Invoice Payment: 6 Steps to Get Paid

Following up on unpaid invoices requires a structured, professional approach. Here’s how to do it:

1. Send a Polite Reminder Before the Due Date

Start with a polite email or message to remind the client before the invoice is due. Sometimes, delays happen because of oversight or a busy schedule. Many late payments happen because clients simply forget.

Include the invoice number, amount due, and payment deadline.

For example:

“Hi [Client], I hope this message finds you well.

Just a quick reminder that Invoice [12345] for $1,000 was due on [date]. Please let me know if payment has already been made or if you need any details to complete the transaction.

Thank you!”

This gentle reminder often prompts immediate action without straining your relationship.

2. Follow Up Regularly for Overdue Payments

If the payment is overdue, follow up consistently. Send reminders every 10–14 days, adjusting to the client’s payment behavior. For habitual late payers, you might need to follow up more frequently.

Switch between channels, such as email and phone calls, to ensure your message reaches the client. A phone call can be especially effective because it’s harder to ignore.

If the email goes unanswered, make a personal phone call. Speaking directly with your client adds a sense of urgency and gives you the chance to address any concerns they might have.

During the call:

- Confirm they’ve received the invoice.

- Politely ask if there’s any issue delaying payment.

- Request a firm date for when they can complete the payment.

A calm and professional tone is crucial. For example:

“Hi [Client], this is [Your Name] from [Your Business]. I wanted to check in regarding Invoice [12345], which is now overdue.

Is there anything I can help with to ensure the payment is processed? Please let me know when I can expect it.

Thank you!”

3. Suspend Work Until Payment is Made

If a client consistently ignores reminders or refuses to pay, stop any ongoing work until the overdue invoices are cleared. Continuing to provide services or deliver products without payment puts your business at risk.

Communicate this decision clearly:

“Dear [Client], as Invoice [12345] remains unpaid; we will need to pause any further work until the outstanding payment is cleared in full.

Please let me know if there’s an issue we can resolve to move forward.“

Even though this feels risky, it’s necessary to protect your business.

4. Reissue the Invoice Marked as ‘Overdue’

If there’s still no response, resend the invoice with “OVERDUE” written clearly at the top. This emphasizes the urgency and importance of settling the payment.

Attach this to your follow-up email and include any applicable late fees if they were outlined in your terms.

For example:

“Dear [Client], I’m resending Invoice [12345], which remains unpaid.

As of [date], a late fee of [$amount] has been added in accordance with our agreement. Kindly process the payment by [new deadline].

Please reach out if you have any questions.“

A clear, professional approach helps emphasize your payment terms without damaging the client relationship.

5. Offer Flexible Payment Options

If the client is struggling to pay, consider offering options that make it easier for them. These can encourage them to pay sooner while preserving your working relationship. You could:

- Accept credit cards, bank transfers, or online payments through platforms like PayPal or Stripe.

- Propose a payment plan, breaking the amount into smaller installments over time.

For example:

“I understand it may be difficult to pay the full amount at once. To assist, I can arrange a payment plan where you pay [$amount] every two weeks until the balance is cleared.“

6. Send a Final Warning Before Taking Action

If the client still doesn’t respond or pay after multiple attempts, send a formal final notice. Make it clear that non-payment can result in further actions, such as involving a collections agency or pursuing legal remedies.

For example:

“Dear [Client], despite multiple reminders, Invoice [12345] remains unpaid.

This is a final notice requesting payment within [specific timeframe, e.g., 7 days].

If the payment is not received, I may have to escalate the matter further, which could include hiring a collections agency or legal action.

Please let me know if there’s anything preventing the payment from being processed. Thank you for your immediate attention to this matter.”

If the final warning is ignored, consider:

- Hire a Debt Collection Agency: This can help recover the money, but keep in mind they usually take a percentage of the payment.

- Seek Legal Action: Consult a lawyer to explore options like sending a formal demand letter or filing a claim in small claims court.

You can maintain a positive relationship with your clients while approaching them systematically using these steps.

Further Read: How to Request Payment from Client (With Tips and Templates)

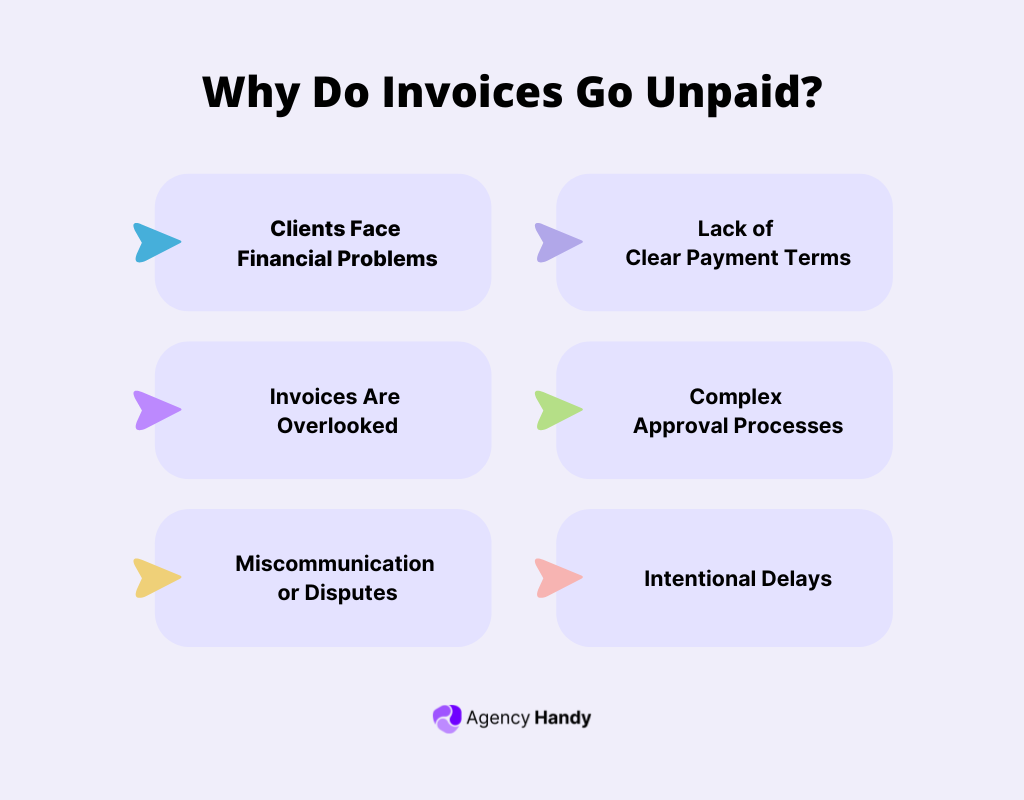

Why Do Invoices Go Unpaid?

Late or unpaid invoices are a frustrating reality for many businesses. To tackle the issue, it’s important to understand why payments are delayed in the first place. Here are some common reasons:

1. Clients Face Financial Problems: Sometimes, clients simply don’t have the money to pay. They might be experiencing cash flow issues or struggling with their own overdue payments. These situations often lead to delays, even when the intention to pay is there.

2. Invoices Are Overlooked: Invoices can get lost in a busy inbox or forgotten in the middle of hectic schedules. This is especially common with clients who don’t have proper systems in place for tracking payments.

3. Miscommunication or Disputes: If there’s confusion about the charges, the scope of work, or the quality of services, clients may delay payment. These disputes often arise from unclear contracts or poorly detailed invoices.

Further Read: Top 12 Client Communication Tools for Businesses

4. Lack of Clear Payment Terms: When due dates, late fees, or payment methods aren’t clearly stated, clients may not feel the urgency to pay. A lack of clear communication upfront can lead to unnecessary delays.

5. Complex Approval Processes: In larger companies, invoices often go through multiple layers of approval before payment is made. This can cause delays, even if there are no issues with the invoice itself.

6. Intentional Delays: Unfortunately, some clients intentionally delay payments to manage their cash flow. They might stretch your payment to prioritize other expenses.

Legal Options for Chasing Invoice Payments (As a Last Resort)

When a client refuses to pay despite multiple reminders, you may need to take legal action. Here’s what you can do to recover your money:

1. Understand Your Rights

Laws on late payments vary by region, but many allow businesses to charge interest or late fees. If your contract or invoice includes a late fee policy, you have legal backing to enforce it. This also sets clear expectations from the start.

2. Issue a Final Demand Letter

A demand letter is a formal request for payment. It also warns of possible consequences, like legal action or additional fees.

Example:

“Dear [Client], despite multiple reminders, Invoice [12345] remains unpaid. Please settle the balance of [$amount] by [specific date] to avoid further action.”

Many clients pay after receiving a demand letter, avoiding further escalation.

3. Take It to Small Claims Court

If the amount is within the small claims court limit, this is a simple and cost-effective way to recover your money. Gather all supporting documents, including invoices, contracts, and emails, to strengthen your case.

4. Hire a Debt Collection Agency

For larger amounts, a collection agency can help recover unpaid invoices. They take a percentage of the recovered funds, but their expertise can save you time and stress.

5. Seek Legal Advice

For high-value debts or complex cases, legal advice is essential. A lawyer can guide you on filing a lawsuit, enforcing payment, or placing a lien on the client’s property. Since legal action can be costly, consider it your last option.

If your client still refuses to pay, these steps give you a clear path forward.

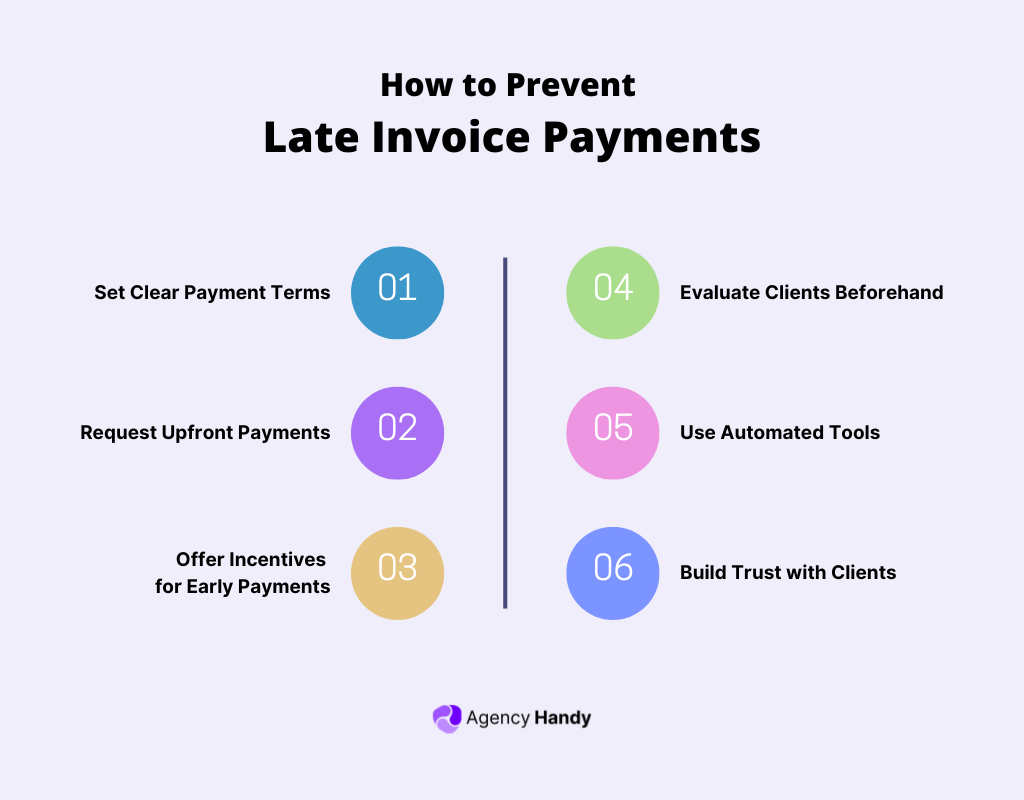

How to Prevent Late Invoice Payments

Chasing overdue invoices is frustrating and time-consuming. Taking the right steps early can help you avoid the hassle. Here’s how to ensure clients pay on time:

1. Set Clear Payment Terms

Make sure your contract includes detailed payment terms. Specify due dates, accepted payment methods, and late fees. Highlight these terms on every invoice so there’s no confusion.

2. Request Upfront Payments

Protect your cash flow by asking for partial payment before starting work. For example, 50% of the money should be collected upfront, and the rest will be collected upon completion.

Waiting until the end of a project to get paid can be risky. With Agency Handy, you can invoice clients at the start, middle, or end of a project—or even a mix of these. Simply add their details, and you’re set.

3. Offer Incentives for Early Payments

Encourage quick payments by offering small discounts. A 2% discount for payments made within 10 days can motivate clients to settle invoices faster.

With Agency Handy’s coupon system, you can create customized discounts for one-time or recurring services. This helps attract clients while ensuring steady cash flow.

4. Evaluate Clients Beforehand

Before signing a contract, research new clients. Ask for references or check their payment history to avoid working with those who often delay payments.

5. Use Automated Tools

Manual invoicing can lead to delays and missed follow-ups. Use invoicing software to track payments, send reminders, and automate follow-ups to reduce payment delays.

With Agency Handy, you can set up automated reminders for upcoming and overdue payments.

Simply select a payment reminder template like “Upcoming Invoice Reminder” or “Overdue Invoice Reminder” and schedule it to go out before or after the due date.

6. Build Trust with Clients

Clients who trust and value your work are more likely to pay on time. Maintain clear communication and deliver quality work to encourage prompt payments.

A proactive approach saves you from financial stress and lets you focus on growing your business instead of chasing overdue invoices.

Best Practices for Chasing Invoice Payments

Chasing overdue payments doesn’t have to strain your client relationships or your time. Follow these steps to handle unpaid invoices professionally and efficiently.

Confirm Invoice Receipt

One of the simplest ways to avoid late payments is to confirm that your client has received the invoice. Many delays happen because invoices are overlooked or lost in communication.

A quick follow-up email ensures the invoice has reached the right person. It also gives the client a chance to ask questions or clarify any concerns early.

Create a Late Payment Policy

Before you even begin work, have a clear late payment policy outlined in your contract or agreement. Specify any fees, penalties, or interest rates for overdue payments.

For example:

“A late fee of 2% of the total invoice will apply for payments overdue by more than 14 days.”

Including this policy upfront gives clients a clear incentive to pay on time and avoids surprises later.

Avoid Overextending Credit to Clients

Offering credit to clients can help secure more work, but it also increases the risk of late payments. Be cautious about extending credit to clients without first assessing their reliability.

For new clients, request upfront payments or set stricter payment terms (e.g., shorter deadlines or milestone-based payments).

For existing clients with poor payment histories, you may need to reduce their credit limits or shift to a pay-before-work model.

Schedule Regular Invoice Reviews

Take time to review all your invoices regularly to track overdue payments. By staying on top of your accounts, you can identify patterns, such as repeat late payers or common delays.

Use this information to adjust your payment terms or follow-up schedules for clients who frequently pay late. Proactive monitoring keeps your cash flow healthy and minimizes surprises.

Know When to Involve a Third Party

If a client consistently refuses to pay despite your reminders and efforts, it may be time to bring in a third party. This could mean hiring a debt collection agency or consulting a lawyer to issue a formal demand letter.

While these steps should be your last resort, they send a clear message that you are serious about recovering your payment. Keep all communication and documentation handy to support your case if needed.

Final Words

Chasing unpaid invoices isn’t easy, but it’s necessary to keep your business running smoothly. Staying professional and consistent helps you recover payments while maintaining strong client relationships.

Understanding why invoices go unpaid is the first step to handling them effectively. Clear communication, flexible payment options, and knowing your legal rights can improve your chances of getting paid on time.

More importantly, focus on preventing late payments before they happen. Setting clear terms, requesting deposits, and sending reminders can reduce delays and keep your cash flow steady.

FAQs

How soon should I start following up on an unpaid invoice?

Start following up as soon as the due date passes. Send a polite reminder the next day so the client doesn’t forget. The faster you act, the sooner you’ll get paid.

What should I do if the client claims they never received the invoice?

Check their email address and confirm how they prefer to receive invoices. Resend it with the due date, amount, and invoice number. To prevent this in the future, ask for a quick confirmation when you send an invoice.

Can I add late fees if they weren’t mentioned in the original agreement?

No, you can’t add late fees unless they were clearly stated in your terms. Charging unexpected fees can hurt client relationships. Always include a late fee policy upfront to avoid this issue.

How do I handle clients who regularly pay late?

For repeat late payers, require deposits or shorter payment terms. This ensures you get paid before completing the work. You can also have an honest conversation. Let them know delays affect your business and may impact future projects.

Should I stop working with a client who refuses to pay?

Yes. If a client refuses to pay, pause all work and let them know in writing. While you might lose the client, you’ll protect your time and money. Focus on clients who respect your terms.

Can I use automated tools to handle late payments?

Yes! Tools like Agency Handy can send reminders, track invoices, and automate follow-ups. Automation keeps everything organized, reduces stress, and improves cash flow.